Sustainability Practices

At Copel, the commitments to sustainability are included in the strategic framework, set out in the Company’s mission, vision and values, as well as in the strategic guidelines, established in the Sustainability and Corporate Governance policies, and are aligned with business planning, as well as linked to the strategic objective “Expand and disseminate the best ESG practices and strengthen risk management, internal controls and compliance”.

Copel adopts as methodologies for sustainability management the methodologies, standards and certification platforms that are references in the preparation of reports, structuring of processes and classification of best practices for sustainable growth. Every year, during the Strategic Planning review process, performance indicators and targets are defined for these tools, resulting in a continuous improvement process.

Methodologies

Among the most widespread methodologies are those dealing with greenhouse gas inventories; the management model; social and environmental responsibility; integrity; and the annual report on corporate sustainability.

Copel uses, among others, the GHG Protocol methodology to draw up its annual Greenhouse Gas (GHG) emissions inventory. The methodology provides international tools and standards for measuring greenhouse gas emissions for the preparation and publication of inventories of this nature.

In 2015, Copel began adapting its reporting to the Integrated Reporting methodology in order to make the document concise and to promote, among stakeholders, the actions to generate value in the short, medium and long term, considering the company’s strategy, governance, performance and perspectives.

In order to provide an even greater understanding of the company’s business performance, Copel uses the structure drawn up by the International Integrated Report Council (IIRC), which governs the preparation of the Integrated Report, an annual public communication of the results of economic, environmental, social and governance aspects.

Since 2008, Copel publishes the inventory of greenhouse emissions following the standards of this global initiative. As of 2012, the inventory passed to be verified by a third party.

MEG 22 – Organizational management model of the National Quality Foundation (FNQ) that guides the “Best in Management” award by ABRADEE. This model is composed of eight fundamentals:

Commitment – implementation of requirements to meet the needs and expectations of stakeholders and the market, valuing such assumed requirements, considering the processes and relationships, inside and outside the organization, to generate sustainable values.

Responsibility – responding to stakeholders for the impacts of decisions and activities, considering business risks, through honest, responsible, conscientious, ethical and transparent behavior, aiming to meet the needs of present and future generations, regarding the environment, social aspects, economic and financial issues and governance.

Leadership – Ethical, inspiring and committed to excellence in exploring the potential of people and cultures, demonstrating respect and building relationships of trust, working on the development of current and future leaders, interacting with stakeholders and mobilizing people and organizations around values, principles, challenges and strategies.

Systemic thinking – Understanding and addressing interdependent relationships and their effects among the various components that make up the organization, as well as between these and the environment in which they interact, in an adaptable, resilient and innovative manner, ensuring that people seek systemic causes through analysis and decision-making, not restricting themselves to a linear and control-based vision, questioning initial planning and business assumptions.

Processes – Promoting a vision of processes, including their resources, information and assets, in an integrated manner, in the form of a value-added chain, which guides decision-making for the execution of strategies, operations, products and projects, providing learning, transformation, change and agility, ensuring the basis for efficiency and effectiveness, guiding the definition of the most appropriate organizational structure and technologies.

Innovation – Provision of a set of organizational skills that induce the systematic and bold proposition of ideas and knowledge, creating an environment and culture that favor the generation of value, organizational learning and the introduction of innovations for the benefit of the organization and its stakeholders.

Culture – Includes habits, beliefs, behavioral, emotional and cognitive aspects represented by a set of values and ethical and moral principles that are used as a guide and inspiration for the entire organization, in the changes necessary for organizational alignment for the implementation of strategies and in the implementation of processes, creating an environment that stimulates learning, innovation, transformation and excellence.

Results – Results (values generated) of the qualitative and quantitative indicators related to performance in SEVEN PERSPECTIVES – ECONOMIC-FINANCIAL, ENVIRONMENTAL, SOCIAL, CUSTOMERS and MARKET, PEOPLE, SUPPLIERS and PRODUCTS and PROCESSES – of the organization, through management in achieving the success of its strategies and the objectives of the pertinent value-generating processes.

The Ethos Indicators are a management tool that supports companies in the incorporation of sustainability and corporate social responsibility in their business strategies.

Copel uses the Ethos Indicators as a way to manage and measure the level of excellence in relation to sustainability and corporate social responsibility.

The signatory companies of the Business Pact for Integrity and Against Corruption respond annually to a set of questions related to the commitments made at the time of their adhesion.

Copel uses the Ethos Indicators as a way to manage and measure the level of excellence in relation to corporate sustainability.

The Task Force on Climate-Related Financial Disclosures (TCFD) aims to help identify the information needed for investors and other financial market agents to properly assess and price the risks and opportunities related to climate change. Its recommendations are based on four elements of climate change management: governance, strategy, risk management and metrics and targets. At Copel, climate change management is governed by the Sustainability Policy – Climate Change chapter, and by the internal Climate Change Effects Management standard, which integrate these four elements, and are annually assessed by the Carbon Disclosure Project (CDP). Since 2021, Copel’s Integrated Report has featured a section dedicated to the TCFD recommendations. Know more.

Standards

In order to promote continuous improvement in its sustainability performance, Copel guides its actions and procedures according to best practices, applying international standards that are widely used and validated by the market.

Sustainability Assessments

Copel submits itself to the main sustainability assessments in order to align its management and strategy with sustainable development.

Through the Sustainability Indicators, companies and the market demonstrate the importance, weight and veracity of actions related to ESG dimensions (environmental, social and governance), demonstrating to investors the seriousness of management, the solidity of the commitment to longevity and the reliability of the results.

Below we highlight the main platforms used by Copel:

Copel, committed to sustainable development, publishes, on an annual basis, its information on climate change management in the Carbon Disclosure Project (CDP) portal. Currently, Copel’s concept is A-.

Investors moves toward sustainability brought even more responsibility to companies, which must now go beyond socioenvironmental responsibility and integrate ESG factors (Environmental, Social and Governance) in their operations and strategies, adding value int he short, medium and long terms.

In addition to corporate reports – Financial Statements, Press Releases, Presentations and the Integrated Report, investors base their investment decisions on sustainability ratings and indices prepared by specialized companies.

Among the most important is the Dow Jones Sustainability Index (DJSI), which uses the Corporate Sustainability Assessment (CSA) questionnaire from S&P Global as a classification tool.

Copel’s participation in the process allows it to analyze in which level is the Company’s sustainability performance compared to its peers across the world. The result allows the Company to set strategies to move forward in its sustainability performance in the coming years.

FTSE4Good is a corporate sustainability index prepared by the Financial Times and its purpose is to rank companies according to their performance pursuant to environmental, social and governance indicators. Investors all over the world use this type of index for making investment decisions. Copel is currently in the FTSE4Good Index Series, with an ESG Rating score of 3.7 (on a scale of 0 to 5).

The trend towards responsible investments has become a rule in the stock market, as it attests to companies’ preparedness to face economic, environmental and social risks, adding value to stakeholders in their activities in the long term.

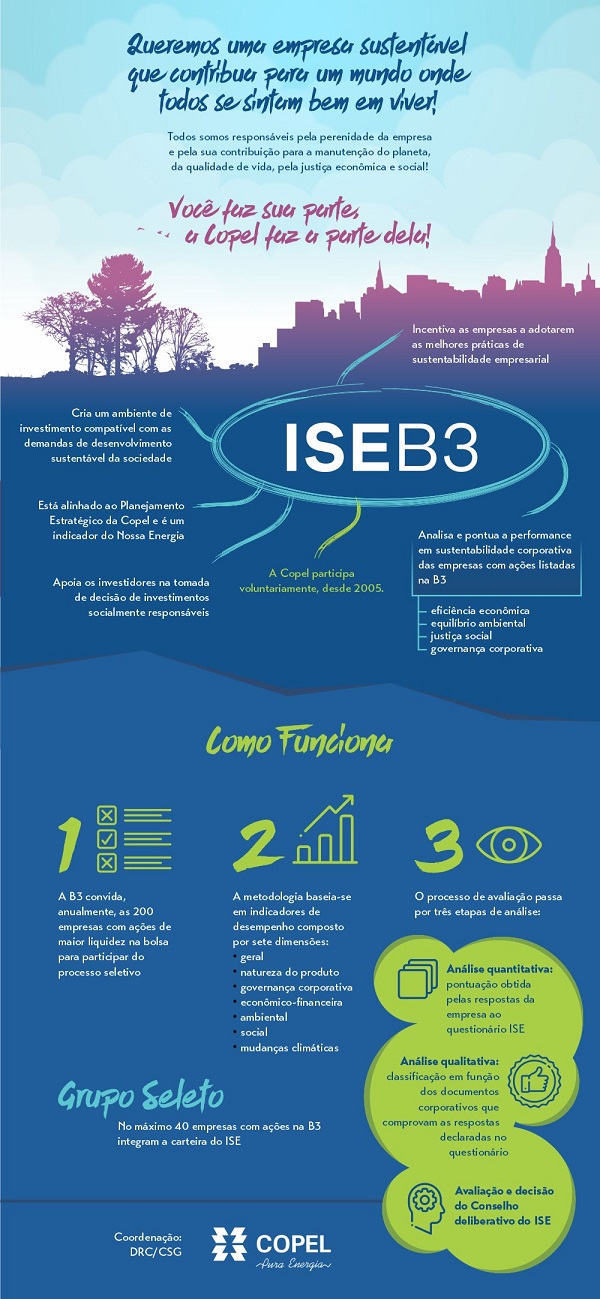

Created in 2005, the Corporate Sustainability Index (ISE) was the first stock portfolio in Latin America to evaluate sustainability aspects for its selection, following global trends in socially responsible investments (SRI). The index includes companies with the most liquid shares listed on the São Paulo stock exchange, whose performance in the evaluation process attests to their commitment to corporate sustainability, equity, transparency and accountability.

Being on the ISE B3 is a criterion that can support strategic decision-making and is a reference for investors who evaluate business activities from the perspective of sustainable development, considering ESG (Environment, Social and Governance) or ASG (in Portuguese) aspects.

Companies that make up the ISE B3 must meet a series of highly demanding requirements, which include a RepRisk rating of 50 or lower, a CDP rating of C or higher, and a minimum qualitative performance of 70%. Companies are reassessed every four months and, if they perform below expectations, they may be removed from the portfolio during this recalibration.

Being part of the ISE B3 is an important distinction in a market that evaluates companies’ ESG orientation as a requirement for investment opportunities.

Institutional Shareholder Services (ISS) is a group of companies founded in 1985 and majority owned by the Deutsche Börse Group that advises investors interested in companies focused on ESG practices.

ISS’s ESG ratings of companies, countries and green bonds provide investors with insight into sustainability in their investment decisions. The research carried out by the institution aims to help investors make decisions based on the analysis of environmental, social and governance risks, opportunities, regulatory requirements and interested parties. Copel’s performance in the ISS ESG classification (sustainable investment arm of ISS STOXX) is currently C.

MSCI ESG Rating is a classification that measures the performance of companies in the long term, based on environmental, social and governance risks. The classification goes from AAA (best performance) to CCC (worst performance), and is the result of the relationship between the risk identified and the management of that risk by the Company. Currently, Copel is rated A.

Sustainalytics’ ESG Risk Ratings measure a company’s exposure to material industry-specific risks and analyze how well the company performs in managing these risks. This multidimensional model of measuring environmental, social and governance risks combines the concepts of management and exposure to arrive at an absolute assessment of ESG risks. The Sustainalytics assessment identifies five categories of ESG risk severity that can impact a company’s value. Copel is classified as Medium ESG Risk.

Affiliations, Associations and Organizations

Representation in associations in the electricity sector and the performance of Copel’s regulatory area, together with its technical areas, favor the Company’s active participation in the sector’s regulatory processes, according to the interests of its stakeholders and society as a whole.

This participation occurs within the scope of the subsidiaries, through representatives with notorious knowledge in their business. Copel (Holding) participates in entities aimed at promoting sustainability, as well as making a series of commitments in this regard.

Get to know the entities in which the Company’s wholly-owned subsidiaries participate, by accessing the Company’s Integrated Reports and the Social and Environmental Reports of the subsidiaries.