Sustainability Practices

At Copel, the commitments to sustainability are included in the strategic framework, set out in the Company’s mission, vision and values, as well as in the strategic guidelines, established in the Sustainability, Environmental, Human Rights and Corporate Governance policies, and are aligned with business planning, as well as linked to the strategic objective “Expand and disseminate the best ESG practices and strengthen risk management, internal controls and compliance”.

Copel adopts as methodologies for sustainability management the methodologies, standards and certification platforms that are references in the preparation of reports, structuring of processes and classification of best practices for sustainable growth. Every year, during the Strategic Planning review process, performance indicators and targets are defined for these tools, resulting in a continuous improvement process.

Methodologies

Copel uses the GHG Protocol methodology for preparing its annual inventory of Greenhouse Gas emissions (GEE).

The methodology provides tools and international standards for measuring greenhouse emissions for preparing and publishing inventories of this nature.

The inventory is the main instrument for managing greenhouse gases, and it is fundamental for making decisions on actions relative to fighting global warming and climate change.

in 2015, the Company started the move to adapt its report to the Integrated Reporting methodology.

Since 2008, Copel publishes the inventory of greenhouse emissions following the standards of this global initiative. As of 2012, the inventory passed to be verified by a third party.

The reference model in organizational management that substantiates the “Best in Management” prize of the National Quality Foundation (FNQ). Consisting of eight principles, among which Sustainable Development, formed by economic-financial, environmental and social themes.

The Ethos Indicators are a management tool that supports companies in the incorporation of sustainability and corporate social responsibility in their business strategies.

Copel uses the Ethos Indicators as a way to manage and measure the level of excellence in relation to sustainability and corporate social responsibility.

The signatory companies of the Business Pact for Integrity and Against Corruption respond annually to a set of questions related to the commitments made at the time of their adhesion.

Copel uses the Ethos Indicators as a way to manage and measure the level of excellence in relation to corporate sustainability.

Standards

With the goal of continuously improving its performance in sustainability, Copel guides its Standards and procedures in best practices, applying broadly used international standards validated by the market.

For standardizing its sustainability indicators (or non-financial indicators) Copel adopts the guidelines of the Global Reporting Initiative (GRI), known as the GRI Standards.

The GRI Standards present common language for organizations and stakeholders, for the purpose of improving understanding of the economic, environmental social and governance impacts of companies and their activities.

Global Reporting

Initiative

Sustainability Assessments

Copel adheres to the main market practices that drive companies towards the development of sustainability linked to their management and strategy.

Through the Sustainability Indicators, companies and the market demonstrate the importance, weight and veracity of actions related to ESG dimensions (environmental, social and governance), demonstrating to investors the seriousness of management, the solidity of the commitment to longevity and the reliability of the results.

Below we highlight the main platforms used by Copel:

The trend towards responsible investments has become a rule in the stock market, as it attests to the preparedness of companies to face economic, environmental and social risks, adding value to the stakeholders in their activities over the long term.

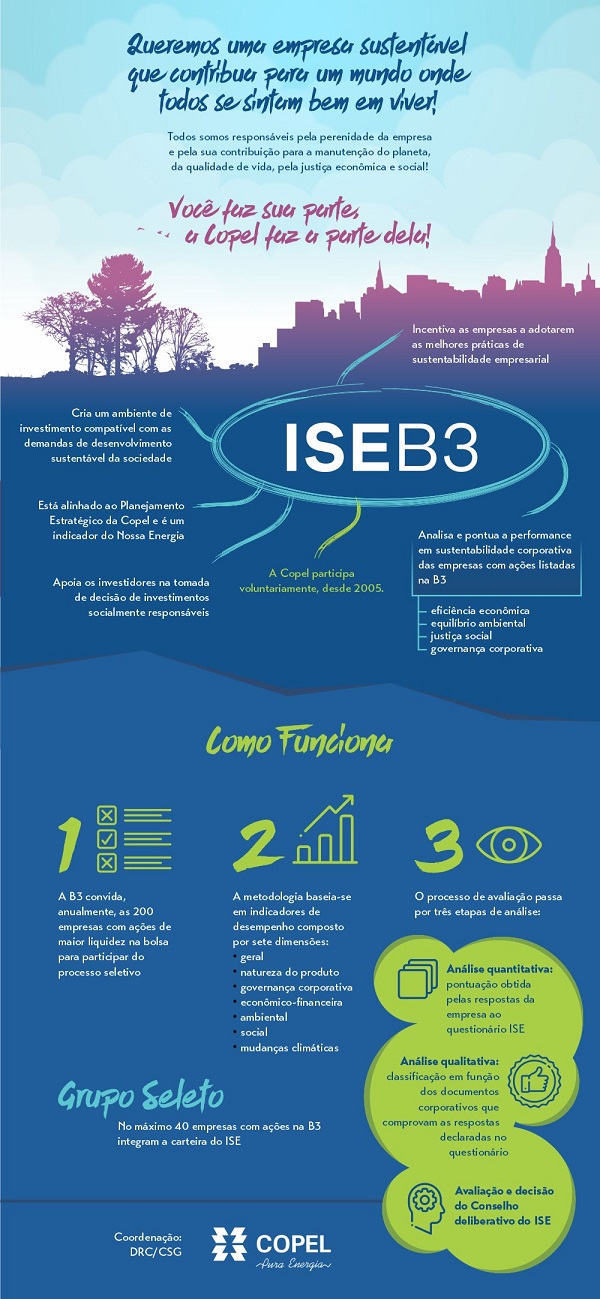

Created in 2005, the ISE was Latin America’s first portfolio on this subject, following global trends in socially responsible investments (SRI). The index includes companies with the most liquid shares listed on the stock exchange, whose performance in the evaluation process attests to their commitment to corporate sustainability, fairness, transparency and accountability.

In addition, it subsidizes decision-making and is a reference for investors who evaluate business activities from the perspective of sustainable development, considering ESG (Environment, Social and Governance) or ASG (in Portuguese) aspects.

The companies that make up the B3 ISE must meet a series of high-level requirements, which include a RepRisk rating of 50 or less, a CDP grade of C or more, and a minimum qualitative performance of 70%. Companies are re-evaluated every four months and, depending on their underperformance in this recalibration, may be removed from the portfolio.

Copel joined the ISE B3 in 2022, having reached 11th place among the companies in the portfolio. Among the companies in the Brazilian Electricity Sector (SEB), it ranks 4th. Being part of the ISE B3 is an important differentiator for the market concerned with the ESG orientation of companies and one of the factors taken into consideration by investors.

Copel, committed to sustainable development, publishes, on an annual basis, its information on climate change management in the Carbon Disclosure Project (CDP) portal.

Investors moves toward sustainability brought even more responsibility to companies, which must now go beyond socioenvironmental responsibility and integrate ESG factors (Environmental, Social and Governance) in their operations and strategies, adding value int he short, medium and long terms.

In addition to corporate reports – Financial Statements, Press Releases, Presentations and the Integrated Report, investors base their investment decisions on sustainability ratings and indices prepared by specialized companies, among the most important is the Dow Jones Sustainability Index.

Copel’s participation in the process allows it to analyze in which level is the Company’s sustainability performance compared to its peers across the world. The result allows the Company to set strategies to move forward in its sustainability performance in the coming years.

FTSE4Good is a corporate sustainability index prepared by the Financial Times and its purpose is to rank companies according to their performance pursuant to environmental, social and governance indicators. Investors all over the world use this type of index for making investment decisions. Copel is currently in the FTSE4Good Index Series, with an ESG Rating score of 3.8 (on a scale of 0 to 5).

MSCI ESG Rating is a classification that measures the performance of companies in the long term, based on environmental, social and governance risks. The classification goes from AAA (best performance) to CCC (worst performance), and is the result of the relationship between the risk identified and the management of that risk by the Company. Currently, Copel is rated BBB.

Sustainalytics’ ESG Risk Ratings measure a company’s exposure to material industry-specific risks and analyze how well the company performs in managing these risks. This multidimensional model of measuring environmental, social and governance risks combines the concepts of management and exposure to arrive at an absolute assessment of ESG risks. The Sustainalytics assessment identifies five categories of ESG risk severity that can impact a company’s value. Copel is classified as Medium ESG Risk.

The Task-Force on Climate-Related Financial Disclosures (TCFD) aims to help identify the information necessary for investors and other financial market agents to adequately assess and price climate change-related risks and opportunities. Its recommendations are based on four elements of climate change management: governance, strategy, risk management, and metrics and targets. At Copel, climate change management is governed by the Climate Change Policy, and by the internal norm of Management of Effects of Climate Change, which integrate these four elements, and are annually assessed by the Carbon Disclosure Project (CDP). The Integrated Report Copel 2021 presents a section dedicated to the TCFD recommendations.

Affiliations, Associations and Organizations

Representation in associations in the electricity sector and the performance of Copel’s regulatory area, together with its technical areas, favor the Company’s active participation in the sector’s regulatory processes, according to the interests of its stakeholders and society as a whole.

This participation occurs within the scope of the subsidiaries, through representatives with notorious knowledge in their business. Copel (Holding) participates in entities aimed at promoting sustainability, as well as making a series of commitments in this regard.

Get to know the entities in which the Company’s wholly-owned subsidiaries participate, by accessing the Company’s Integrated Reports and the Social and Environmental Reports of the subsidiaries